As the world’s economy is in crisis due to inflation with the decrease in gross domestic price (GDP), experts expect the real estate price will also drop. According to records where Korea was affected by the foreign exchange crisis and the Lehman shock, real estate prices consistently decreased and even dropped when GDP fell.. In addition, even the United Arab Emirates, which survived the Lehman shock with fuel exports, showed a sudden drop in real estate in late 2014 when their GDP dropped as well.

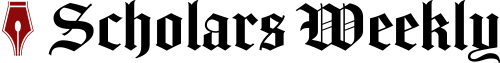

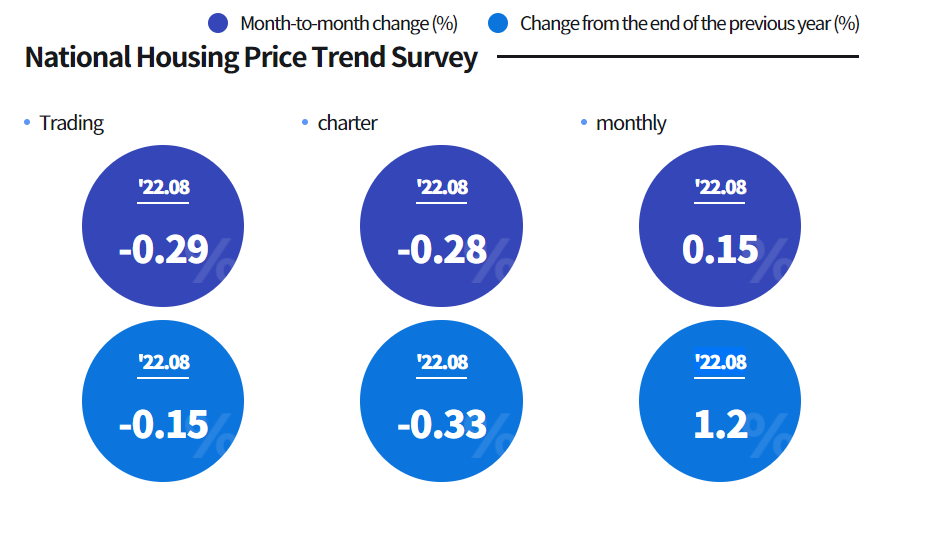

According to the Korea Real Estate Agency, the average drop in national real estate prices recorded the highest percentage since the 2nd week of May 2012. It is significant because even the real estate in Seoul and metropolitan areas are included in this drop. This drop has been noted to be about 0.2 percent which is nearly 277,000 dollars. It is not correct to say that all this drop is due to inflation and a decrease in GDP since it is also affected by regulations and the government’s political propensity. Besides, it is more important to focus on the young generations’ (the 20s and 30s) situations rather than finding the cause.

Starting from 2020, when stocks and bitcoins were highlighted throughout the whole world, young generations in Korea tended to buy their own house disregarding the risk of numerous debts. It is not ordinary for people, especially these beginners in society to make up for their debts within 2 years. And as the interest rate increases, their debts will increase rather than decrease, discouraging them. Therefore, we need support from organizations or some regulations to help them reduce pressure to save these poor people.

Works Cited

“‘떨어지면 다 망한다’…한국 집값, 폭락하면 반등은 없다?” 땅집고 > 땅집고TV, 28 July 2022, realty.chosun.com/site/data/html_dir/2022/07/28/2022072802600.html.

“주간 서울 아파트값 9년 만에 최대폭 하락…‘폭락’ 향해 가나.” 경향신문, 8 Sept. 2022, m.khan.co.kr/economy/economy-general/article/202209081400001#c2b.

By. Sonbom Lee