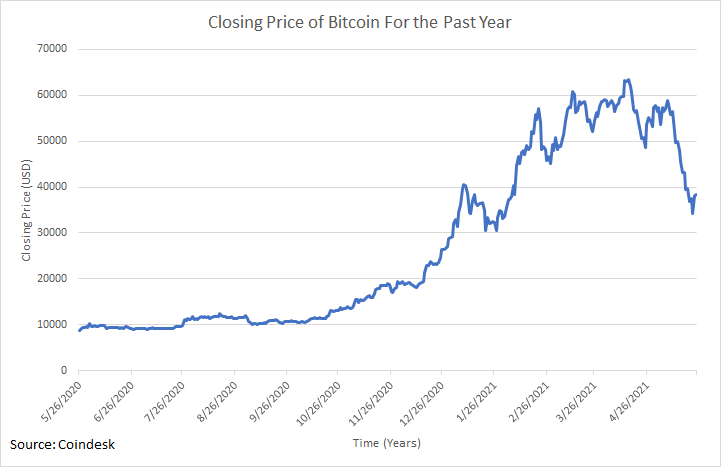

The economies of the old world used to trade gold and silver as currency. However, our modern societies have transitioned to fiat currencies like the US dollar and the South Korean Won. Unlike gold, fiat currencies like Bitcoin and Etherium hold no intrinsic value but rather they derive value from supply and demand. Fiat currencies are unique because cryptocurrencies are not regulated by a central bank and exist on a decentralized platform, meaning that cryptocurrency is measured for whatever people are willing to pay for it. This has led to explosive growth in the particular cryptocurrency industry, going from 10k to 60k each in less than one year. Other cryptocurrencies have also seen high return rates, such as Dogecoin posting 14,000% returns at one point since the start of the year. However, while the explosive growth of specific cryptocurrencies has attracted investors, the general public should still be mindful of certain risks when deciding whether to invest or not.

One of the risks is decentralization. Because the government has no power to control cryptocurrencies, there is no centralized party that affects the cryptocurrencies’ price. Unfortunately, this means that the users can’t protect themselves from losing their passwords or fraud because no government agencies can intervene. Another risk is rapid price fluctuation. Although this is a risk that happens usually in traditional stock markets, cryptocurrencies fluctuate in a broader range.

Cryptocurrencies are still new, and as time progresses, the market will also develop. However, with the recent surge in attention on cryptocurrencies, people might invest money without understanding the underlying technology or risks, which dangers the possibility of losing massive amounts of money.

By: Brenson Ha