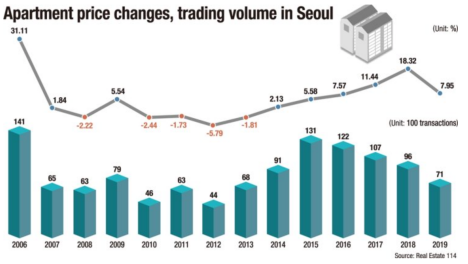

Housing prices in Korea have been on the rise since the subprime mortgage crisis. This is because the Park Geun Hye regime encouraged low-interest loans to encourage people to buy homes. Until this time, however, the bubble in the real estate market wasn’t so bad.

In 2017, the Moon Jae-in government vowed to catch the property bubble. However, 28 real estate measures have been proposed in five years, but they have had adverse effects. In the era of low interest rates, various loan regulations were eased, and, as a result of excessive populist policies, not only prices but also housing prices began to soar. In the end, the theory of failure to invest in real estate, which had been dead for a while, emerged again, and people borrowed money and bought a house. In particular, the 2030 generation began to enter the real estate market, which was already supersaturated, as they began to enjoy significant investments or speculation in conjunction with the growth of the coin market. However, no one knew what would happen in 2022.

Global economic conditions began to deteriorate, coupled with resource shortages and fuel hikes caused by Russia’s invasion of Ukraine, and stock investors became reluctant to invest in risky industries. The exchange rate soared dramatically at first, and the stock market began to collapse later on. The KOSPI, which once reached the 3,000 won level, fell apart by ⅔. The deterioration of the stock market has occurred in most countries. The same was true of the U.S., and the U.S. Federal Reserve Bank began raising interest rates this year when unemployment was already extremely high and inflation was soaring. The Bank of Korea also continued to raise interest rates to defend its currency, which soon began to weigh heavily on borrowers. In particular, people who took out loans to buy expensive homes suffered much damage. However, the market cooled rapidly, and people no longer wanted to buy or rent houses at bubble prices. This can be seen in the lease price that has fallen since the middle of 2022 (Kim).

To make matters worse, the Lego Land crisis, which local governments declared to default on construction companies’ debts, led to an ice age in the construction market itself, ending the 10-year money festival. Since population decline is already accelerating, there is a high possibility that demand for homes will decrease.

Works Cited

Kim, Won. “As Jeonse Prices Fall, Owners Get Desperate and Analysts Worry.” Korea JoongAng Daily, 3 Oct. 2022,

koreajoongangdaily.joins.com/2022/10/03/business/economy/korea-real-estate-housin g/20221003164558107.html. Accessed 2 Jan. 2023.

By. Yeongdo Jung