Recently, stocks are a very big issue in Korea and many people are starting to enter since the beginning of Covid-19. There have been many changes in our lives due to the Coronavirus. Among the changes is the global economic situation. So let’s find out how the national stock market has changed until now and how investors can make a profit.

Since the Coronavirus started, the global recession has begun, stocks have been hit hard, and oil prices have dropped sharply. Stock markets in major countries showed a downward trend such as the United States, Japan, Germany, Italy, France, etc. to name a few. Compared to them, Korea showed relatively good conditions. Because of this uncertain situation, Korean individual investors who are unfamiliar with stocks chose safe stocks.

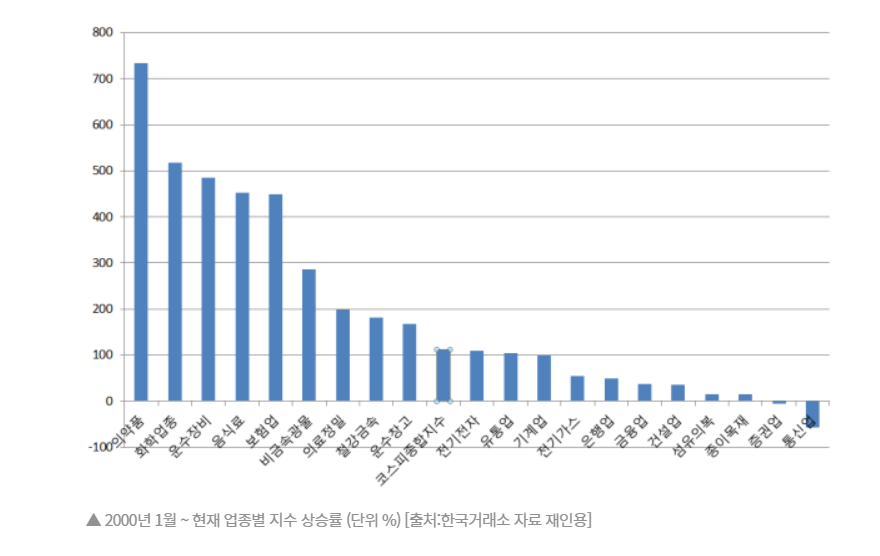

So, what are those safe stocks? As you can see from the graph, you can realize which categories have a small drop. They are medical, chemical, transportation, IT, and telecommunications services. All of these categories are companies that are even slightly related to the Corona situation and can create profitable situations. However, media, construction, shipbuilding, and energy companies have suffered great damage. Jim Rogers, who is known as a stock expert, describes the situation as the so-called “bubble”. Therefore, he rather invests in places that would only increase after Corona, such as aviation, tourism, and transportation. This is called “reverse betting”. There’s a lot of private investors coming in these days, and they prefer short-term investments with high risk.

Personally, I think a more conservative and careful investment method, which is investing in various fields and looking for the situation until the end of Corona will be better. It is also good to invest for a long time, reflecting the future when Corona is over because the outlook for the global market is still unclear and messed up because of it.

By: Youngwoong Cho